The Ultimate Guide to Calculate Overtime in California

Calculating overtime in California can be complex. The state’s wage and hour laws are strict and detailed.

Understanding these laws is crucial for both employees and employers. It ensures fair compensation and compliance with regulations.

California’s overtime rules differ from federal standards. They offer more protection to workers, requiring overtime pay for more situations.

Overtime pay rates in California include time-and-a-half and double time. These rates depend on the number of hours worked.

Bonuses and commissions also affect overtime calculations. They must be included in the regular rate of pay.

Employers must keep accurate records of hours worked and wages paid. This is essential to comply with California labor laws.

Employees have the right to fair pay and can file claims if they are underpaid. Understanding these rights is important for all workers.

This guide will help you navigate California’s overtime calculation rules. It provides clear examples and practical advice.

Understanding California Overtime Laws

California’s overtime laws are some of the most stringent in the United States. These regulations are designed to ensure fair treatment of employees.

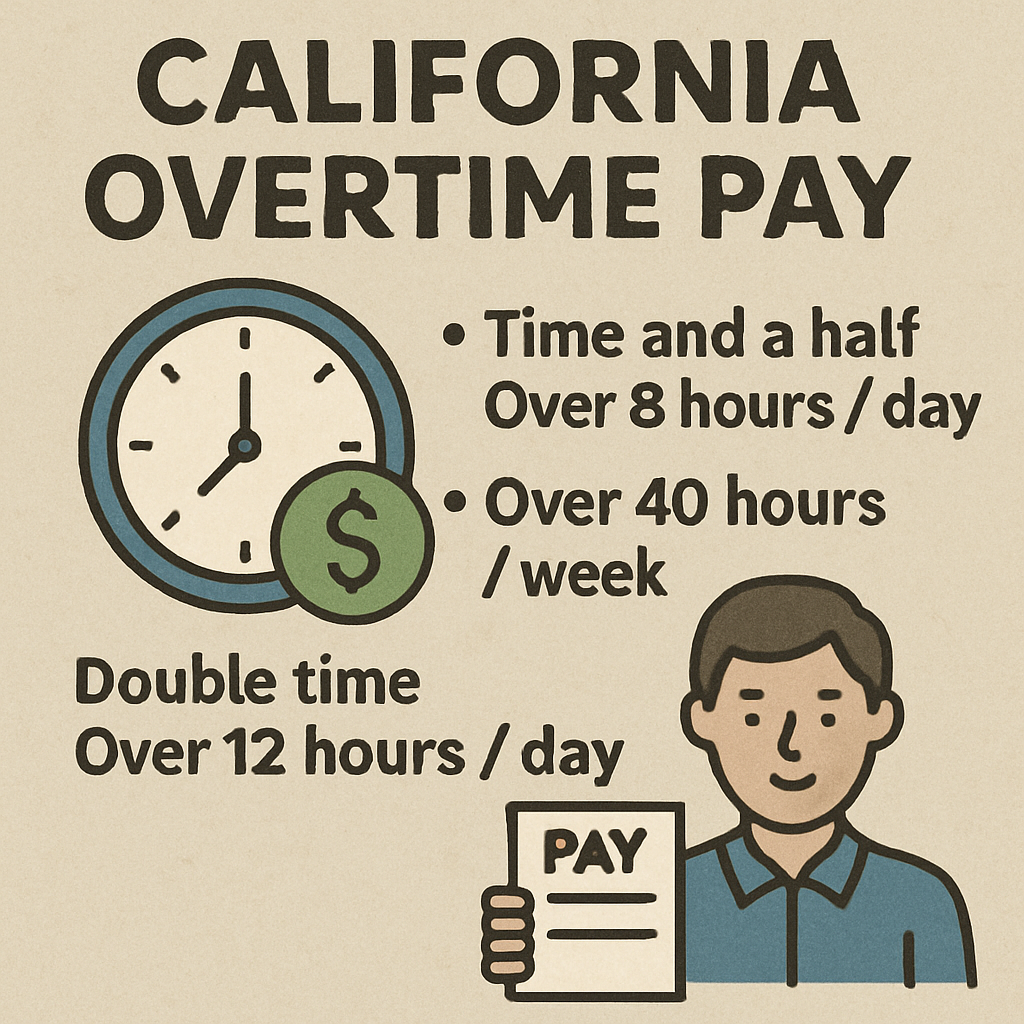

The primary rule for overtime in California is simple. Employees are entitled to overtime pay for hours over eight in a day or 40 in a week.

An important distinction is the “daily overtime” rule. Employees working over 12 hours in a day receive double time pay.

Employers must adhere to these laws without exception. Compliance ensures legal protection and promotes a fair workplace.

In California, non-discretionary bonuses and commissions affect overtime. These earnings are included when calculating the regular rate of pay.

The laws extend beyond pay rates. They require employers to provide meal and rest breaks during shifts.

California Labor Code Section 510 outlines these overtime regulations clearly. Understanding this code is vital for compliance.

Here’s a brief list of key points about California overtime laws:

- Overtime after 8 hours in a day or 40 in a week.

- Double time after 12 hours in a day.

- Meal and rest breaks are mandatory.

Employers and employees alike must keep informed about these regulations. Regular updates ensure adherence and prevent disputes.

Who Is Entitled to Overtime Pay in California?

In California, most non-exempt employees are eligible for overtime pay. However, defining who is “non-exempt” can sometimes be complex.

Non-exempt employees typically work in roles involving manual labor or support functions. These roles are usually not managerial or administrative.

Certain white-collar jobs might also be non-exempt. It depends on their duties and how they are compensated, not just their job titles.

Some workers might mistakenly believe they’re exempt based on a salary. But being salaried alone does not make an employee exempt from overtime.

Exemptions are defined by the California Industrial Welfare Commission (IWC).

Here are some common exemptions:

- Executive, administrative, and professional employees meeting certain criteria.

- Certain sales jobs, primarily outside salespeople.

- Individuals in specific computer-related occupations.

Employees should verify their status under IWC guidelines. Misclassification can lead to denied wages and legal disputes. Understanding these distinctions helps safeguard workers’ rights and aligns with California wage laws.

California Overtime Pay Rates: Time-and-a-Half and Double Time

In California, overtime pay is structured to ensure employees receive fair compensation for extended work hours. It’s a safeguard against excessive work without fair pay.

Employees get overtime pay for any hours over eight in a day. This is calculated at one-and-a-half times their regular rate.

For work beyond 12 hours a day, California mandates double time pay. This aims to deter overly long shifts without proper compensation.

On the seventh consecutive day of work, the rules adjust again. Employees get time-and-a-half for the first eight hours, then double time beyond eight hours.

Understanding these rates is crucial. It can help prevent underpayment and disputes between employees and employers.

Here’s a quick breakdown of the rules:

- Time-and-a-half: Over 8 hours in a day, over 40 in a week, and first 8 on 7th day.

- Double time: Over 12 hours in a day, over 8 hours on the 7th consecutive work day.

Understanding these rates ensures fair practice. Employers must adhere to these standards for compliance with California labor laws.

Defining the Regular Rate of Pay

Calculating overtime in California starts with the regular rate of pay. This is more than just an hourly wage and requires some understanding.

The regular rate includes all forms of compensation. This can be hourly earnings, salaries, and non-discretionary bonuses.

Non-discretionary bonuses are payments promised in advance. They are tied to factors like productivity, efficiency, or attendance.

Commissions also form part of the regular rate. This means sales-based bonuses affect overtime calculations.

It’s vital for employers to calculate this correctly. Missteps here can lead to significant penalties.

Here’s what to include in the regular rate:

- Hourly wages: Your basic hourly pay rate.

- Salaries: Pro-rated for weekly working hours.

- Non-discretionary bonuses: Regular, promised bonuses.

- Commissions: Earnings from sales or similar activities.

Each component is important. Getting it right ensures compliance and fairness. Employers need to consider these elements when determining overtime pay rates. Understanding this principle helps maintain workplace harmony and reduces potential conflicts.

Calculating Overtime for Hourly Employees

Understanding how to calculate overtime for hourly employees in California is crucial. This ensures accurate payment and compliance with state laws.

Hourly workers earn overtime for more than eight hours a day. They also receive it for over 40 hours a week or on the seventh consecutive workday.

The overtime rate in California is typically 1.5 times the regular rate of pay. For hours worked over 12 in a day, double time is applicable.

Here’s how to calculate overtime pay for hourly employees:

- Determine total work hours: Sum daily or weekly hours.

- Identify overtime hours: Count hours over 8 per day or 40 per week.

- Calculate overtime pay: Multiply overtime hours by 1.5 times the regular rate.

- Double time calculation: Apply 2 times the rate for over 12 daily hours.

This method ensures employees receive fair compensation. Employers should keep accurate records to avoid potential disputes or penalties.

Proper calculation and documentation promote a harmonious workplace and foster trust between workers and employers.

Overtime Calculation for Salaried Nonexempt Employees

Salaried nonexempt employees also qualify for overtime pay. However, calculating their overtime involves a different approach than for hourly workers.

First, determine their regular weekly salary. Divide this amount by the total hours they are expected to work per week, typically 40 hours.

This calculation gives you their regular hourly rate. It’s crucial to get this right for accurate overtime payment.

Follow this process for overtime pay calculation:

- Calculate regular hourly rate: Divide weekly salary by 40.

- Determine overtime hours: Identify hours worked over 40 in a week.

- Compute overtime pay: Multiply overtime hours by 1.5 times the regular rate.

Salaried nonexempt employees may also receive double time pay. Hours worked over 12 in a day qualify for this rate.

Accurate calculation prevents wage disputes and ensures compliance. Both employers and employees benefit from clear understanding of these rules.

Employers must adjust paychecks accordingly and track all additional hours worked. This ensures fair compensation for all extra hours worked.

Overtime and Alternative Workweek Schedules

California allows alternative workweek schedules, which can affect how overtime is calculated. These schedules offer flexibility for both employers and employees.

Under an alternative workweek, employees might work more than eight hours a day without receiving overtime. However, they shouldn’t exceed 40 hours a week.

Employers need to follow specific rules to establish these schedules. Here are some key points:

- Voting process: Employees must vote to adopt the alternative workweek.

- Approval needed: Requires two-thirds approval from affected workers.

- Written agreement: Document the agreed schedule officially.

Despite flexibility, daily and weekly overtime rules still apply. For example, hours over the agreed schedule or more than 40 weekly hours earn overtime pay.

It’s essential to maintain compliance with California overtime laws even under alternative schedules. Transparency and clear communication help avoid misunderstandings and legal issues. Employers benefit from consulting legal experts when setting up these schedules.

Overtime Calculation with Non-Discretionary Bonuses

Non-discretionary bonuses significantly impact overtime calculations in California. These bonuses are guaranteed based on set criteria and must be included in the regular pay rate.

Including bonuses in the calculation ensures employees receive fair compensation. It reflects bonuses related to productivity or performance.

Excluding them incorrectly can lead to underpayments and disputes. To prevent this, employers must accurately determine the bonus amount for overtime.

When calculating overtime with non-discretionary bonuses, follow these steps:

- Determine total earnings: Include the bonus with other pay.

- Calculate regular rate: Divide total earnings by total worked hours.

- Apply overtime rates: Multiply the regular rate by 1.5 or 2 for overtime.

Accurate calculations are necessary to comply with California labor laws. Employers should ensure their payroll systems correctly account for bonuses.

Missteps can lead to costly corrections and potential penalties. Consistent training for HR and payroll personnel can minimize errors.

Keeping detailed records of worked hours and bonus payments helps maintain compliance. Employers are encouraged to seek legal advice for complex pay structures involving bonuses.

Overtime Calculation with Commissions and Piece-Rate Pay

In California, calculating overtime for employees earning commissions or piece-rate pay involves unique considerations. Commissions and piece-rate pay must be factored into the regular pay rate to ensure fair compensation.

The calculation for these payment methods can be complex. Commissions are performance-based earnings, while piece-rate is pay for each unit of work completed.

When calculating overtime for these earnings:

- Add total earnings: Include all commissions and piece-rate pay.

- Find the regular rate: Divide total pay by all worked hours.

- Calculate overtime pay: Use 1.5 or 2 times the regular rate for overtime hours.

Unlike hourly rates, the variable nature of commissions and piece-rate pay requires precise calculations to comply with California labor laws. Regular audit of payroll practices is important.

Employers should maintain clear documentation detailing hours worked and commission payments. This ensures transparency and helps resolve any disputes regarding overtime pay calculations.

California FLSA Overtime Calculation vs. State Law

Understanding the difference between California’s overtime laws and the Fair Labor Standards Act (FLSA) is crucial. California’s laws are more stringent and often more beneficial to employees.

The FLSA sets a federal baseline for labor standards. However, California imposes additional requirements to better protect workers’ rights. These include daily overtime pay and higher overtime rates.

Key differences include:

- California requires overtime for hours over 8 in a day.

- Double time is mandated for hours over 12 a day.

- California laws also consider non-discretionary bonuses in the overtime pay calculation.

These laws ensure employees receive fair pay for long work hours. Employers must familiarize themselves with both laws to ensure compliance. Failure to comply can lead to significant penalties and potential legal actions. Understanding these distinctions helps both employees and employers navigate overtime pay complexities effectively.

Special Rules and Exemptions

California overtime laws cover most employees, but there are specific exemptions. These exemptions mainly apply to certain industries and professions. Understanding these exceptions is vital for compliance.

Some workers are classified as exempt from overtime. Typically, this includes executive, administrative, and professional employees. They must meet specific salary and duty requirements set by California law.

Key exemptions include:

- Independent contractors who operate under a separate business.

- Certain seasonal and agricultural workers.

- Employees covered by a valid collective bargaining agreement.

In some cases, workers in specific industries have unique rules, such as nurses or computer software employees. These exemptions often depend on the type of work performed or the level of professional skill required.

Employers must carefully assess employee classifications. Misclassifying employees can lead to penalties and back pay issues. Consulting with legal professionals or a human resources expert is often wise. This ensures correct application of the law and prevents costly errors.

California Overtime Calculation Examples

Understanding overtime calculations requires practical examples. Let’s explore some scenarios that illustrate these complexities.

Consider a standard hourly employee. If they work 10 hours in one day, 2 hours count as overtime. At time-and-a-half, this means they earn 1.5 times their regular hourly rate for those extra 2 hours.

Next, imagine an employee works 45 hours in a single week. Here, the first 40 hours are at the regular rate. The additional 5 hours qualify for overtime pay.

For instance, if the regular hourly rate is $20:

- Regular earnings for 40 hours: 40 × $20 = $800

- Overtime earnings for 5 hours: 5 × $30 = $150

- Total weekly earnings: $800 + $150 = $950

Let’s look at double time calculations. If the employee works 13 hours in one day, they earn double time after 12 hours. Therefore, for the 13th hour, they receive twice their hourly rate.

In another scenario, consider an employee who works seven consecutive days. On the seventh day, they earn time-and-a-half for the first 8 hours. Any work beyond 8 hours is paid at double time.

Here’s a breakdown:

- 8 hours at time-and-a-half rate

- Additional hours at double time rate

Understanding these examples simplifies complex calculations. Employers should always verify overtime pay with accurate calculations. This ensures compliance with California overtime laws.

If bonuses or commissions apply, remember to include these in the regular pay rate. This makes the overtime calculation straightforward and fair for employees. Regular audits help prevent miscalculations and ensure compliance.

Recordkeeping and Employer Responsibilities

Accurate recordkeeping is crucial for employers. It ensures compliance with California labor laws. Employers must meticulously track all hours worked by employees.

Records should include:

- Total hours worked daily

- Regular hourly rate and overtime rate

- Earnings paid, including any overtime

Employers are responsible for maintaining these records for at least three years. This requirement helps ensure transparency and accountability.

Failing to keep precise records can result in penalties. Employers may face audits or fines for non-compliance. Therefore, recordkeeping is a key element of managing payroll effectively.

Providing clear pay stubs to employees is also important. These should detail both regular and overtime pay. Including this information helps employees verify their wages and hours. Consistent recordkeeping practices protect both employers and employees. It fosters a fair and transparent work environment, aligning with California’s wage and hour laws.

Employee Rights and Filing Wage Claims

Employees in California have robust rights under wage laws. Understanding these rights is vital for receiving proper pay. Employees must know they are entitled to accurate overtime compensation.

If an employee suspects underpayment, they should file a wage claim. The Division of Labor Standards Enforcement (DLSE) handles these claims. Filing a claim helps ensure rightful compensation.

Employees can file a claim for issues like:

- Unpaid overtime wages

- Incorrect paycheck amounts

- Misclassification as exempt

Filing a wage claim is a protection mechanism. It ensures employees receive the wages they have earned. It is a straightforward process, but attention to detail is essential.

California laws protect employees from retaliation when filing a claim. This means employers cannot fire or mistreat a worker for asserting their rights. Understanding and exercising these rights helps maintain fair employment standards.

Common Mistakes and How to Avoid Them

Mistakes in overtime calculation can lead to costly penalties. Misunderstanding overtime rules is a common issue. Employers must ensure clarity on California wage laws.

One frequent error involves misclassifying employees as exempt. This can result in unpaid overtime. Carefully review each employee’s classification to avoid this mistake.

Also, failing to include bonuses in the regular rate of pay is common. Non-discretionary bonuses should always be part of this calculation. Ensure payroll systems account for all eligible income.

Employers should avoid these common pitfalls:

- Misclassifying employees as exempt

- Excluding bonuses from regular pay

- Incorrect tracking of work hours

Accurate timekeeping prevents misunderstandings. Employers must maintain precise records of work hours and wages. Regular audits and training can minimize errors. Staying informed on legal updates will help maintain compliance.

Frequently Asked Questions about Overtime in California

What constitutes overtime in California?

Overtime includes hours worked beyond eight in a day or 40 in a week. Double time applies after 12 daily hours.

How is the regular rate of pay determined?

This includes hourly wages plus any non-discretionary bonuses and commissions. It forms the basis for calculating overtime.

Are meal breaks included in overtime calculations?

No, meal breaks do not count as hours worked. They should not be part of overtime calculations.

Do bonuses affect overtime pay?

Yes, non-discretionary bonuses must be included. This impacts the regular rate of pay.

What is the daily overtime rule?

The daily overtime rule requires employers to pay non-exempt employees: 1.5 times their regular rate of pay for hours worked over 8 hours in a single day and double the rate for hours worked over 12.

How are bonuses factored into pay?

Non-discretionary bonuses are factored into the regular rate of pay by dividing the bonus by non-overtime hours worked for flat-sum bonuses or allocating it across all hours for other types, then using the adjusted rate to calculate overtime pay at 1.5 or 2 times for applicable hours.

Are all employees eligible for overtime?

No, not all employees are eligible for overtime in California; non-exempt employees are generally entitled to overtime pay, but exempt employees (such as certain administrative, executive, or professional workers meeting specific salary and duty criteria) are not, per California labor laws.

Key Takeaways for Employers and Employees

California’s overtime laws are designed to protect both employees and employers. Ensuring compliance helps foster a fair workplace.

Employers need to keep accurate records and understand the specific rules for calculating pay. Regular audits of pay practices can prevent costly mistakes.

Employees have rights to fair compensation and should know how overtime impacts their wages. Here’s a quick list to remember:

- Keep updated on overtime rules.

- Ensure accurate recordkeeping.

- Understand bonus and commission impacts.

Staying informed benefits everyone involved in the employment relationship.

Resources and Further Reading

For further information, explore various resources available online. These sources provide detailed guidance on California’s overtime laws.

You might find the following resources valuable:

- California Department of Industrial Relations website

- Federal Fair Labor Standards Act (FLSA) information on the DOL site

These resources can enhance your understanding of compliance and rights.

Legal Resources for California Overtime Pay

If you have been the victim over unpaid overtime you can contact California Labor Law for help. We can assist you with legal options in getting the overtime pay you so rightly deserve. Call 1-866-355-9991 for a free overtime pay consultation. With 30+ years of advocating for workers’ rights: we are the right choice.